Time Value of Money Essay Paper The purpose of this project is to apply some of the concepts covered in the course. Specifically, the project requires you to develop a simple retirement plan.

The approach you should take when completing this project is that the only funds you receive at retirement are those you contribute to specific retirement funds that is, you should assume Social Security will not be available when you retire. In other words, the only funds you will have available at retirement will include amounts you have already accumulated in investments that are specifically designated for retirement and any amounts you accumulate in the future.

Time Value of Money Essay Paper Extra Credit Points

Your extra credit project must follow the format contained in the Word template that you must use for your discussions/explanations and to record the results of your computations (http://sbesley.myweb.usf.edu/FIN3403/retire template-sp19.docx); if it does not, your project will not be graded, which means you will receive a grade of zero (0) for the work you submit.

In addition, you should closely follow the instructions included in this document to ensure that your project is graded and that you do not lose points for not following instructions.

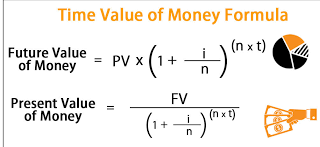

Prior to starting the extra credit project, it is recommended that you work Time Value of Money Assignment #1 that is posted on the course website at http://sbesley.myweb.usf.edu/FIN3403/tvm-1.doc.

If you understand the two problems given in this assignment, you should be able to complete the extra credit project without much difficulty. You must use a spreadsheet to complete the computations required for the project.

The Comprehensive Notes for Chapter 4, which are posted on the course webpage, show how to use the time value of money functions that are available in Excel. The link for the Chapter 4 notes is http://sbesley.myweb.usf.edu/FIN3403/notes/tvm.pdf.

Time Value of Money Essay Paper Requirements of the Project

You should already be planning for your retirement. For this reason, the extra credit project is designed to make you think about retirement now by requiring you to develop a simple, yet viable plan for achieving your retirement goals. Following are the requirements that must be included in the project.

These requirements must be included in (1) the Word template that is available at http://sbesley.myweb.usf.edu/FIN3403/retire template-sp19.docx and (2) the spreadsheet template that must be used to complete the required computations, which is available at http://sbesley.myweb.usf.edu/FIN3403/retire-sp19.xls.

I.Occupation /Career Expectations. Provide a brief description of what you expect (hope) your occupation(s) will be from the time you graduate from college until you retire.

Include in the description the salary range you expect to earn at the various stages of your career. Salary estimates can be obtained from a variety of sources, including USF Career Services and the library, but most of the needed information can be found on the Internet.

To search the Internet, use a key phrase that identifies the area in which you expect to work. For example, if you expect to work in the finance area, the key phrase for your search should be either ìfinance salariesî or ìsalaries in finance.î Estimate your salary in five-year increments rather than annuallyóthat is, estimate the average annual salary for the first five years of your career, the average annual salary for the second five years of your career, and so forth. When estimating the salaries you expect to earn during your career, you must consider expected inflation rates, percentage raises, and the effects of promotions.

Time Value of Money Essay Paper

II.Investment Horizon and Life Expectancy. Determine how long you expect to be able to contribute to a retirement fund to meet your retirement goalsóthat is, the number of years you expect to earn a salary in your chosen career. For example, if you intend to retire at age 65, use the number of years from when you first start your career (upon graduation from USF) until the age of 65. This will constitute your investment horizon, which is the length of time you expect to be able to invest funds to build your retirement ìnest egg.î You must also determine the number of years you expect to live after retirement. To estimate this time period, you must complete the following life expectancy quizzes:

University of Connecticut Healthy Life Expectancy Calculator: https://apps.goldensoncenter.uconn.edu/HLEC/

John Hancock Life Expectancy Calculator: https://www.johnhancockinsurance.com/life-expectancy-calculator.html#

A Life-Expectancy CalculationóFoundation for Infinite Survival, Inc.: http://www.fis.org/LE-Calc/index.html

Poodwaddle Life Clock: http://www.poodwaddle.com/life/. When you finish completing the quiz, print the Summary Report. If you click the tab labeled Full Report, you will be taken to a page that provides information about how to increase your life expectancy.

Hansard International/Fidelity International: https://www.hansard.com/international/fidelity/take-the-questionnaire

The results will appear at the bottom of the page. Below the results you will be provided information about how your lifestyle affects your life expectancy.

The results appear in the upper right portion of the second page of questions.

Time Value of Money Essay Paper

After providing basic information about yourself (gender and age), click ìSubmit Valuesî to go to the next page. The next page will give your life expectancy based on actuarial (insurance) data; you have not finished the life-expectancy quiz; you must provide the ìPersonal Risk-factorsî in the tables that follow on the same page. Provide the information requested in the tables that follow. When finished, click ìSubmit Valuesî at the bottom of the page, and your life expectancy based on your personal risk factors will be computed and shown on the next page. After the results are revealed, click ìProceed to Phase I Life-Extensionî to see your risk factors and how changes in lifestyle will extend your life. Click ìProceed to Phase IIa Life-Extensionî, then click Proceed to Phase IIb Life-Extension,î and finally click ìProceed to Phase IIc Regeneration.î The various screens will indicate how you might be able to extend your actual life expectancy up to 30 years beyond your actuarial life expectancy.

You can access the quizzes by clicking the links given above. If clicking a link does not work, simply copy the link and paste it into the address line of your web browser. The life expectancy quizzes will provide a good estimate as to how long you should expect to live given your current lifestyle. To determine your life expectancy, average the results of the quizzes. You must turn in with your extra credit project a copy of the results for each quiz; so make sure you print the results of each quiz when you complete it. You can use your computerís print screen function (PrtScn key) to print the results that appear on the last page of each quiz.

III.Risk Preferences. Think about the degree of risk you are willing to take when investing to meet your retirement goals, and then describe your risk preferences.

Include in your description a discussion of how you think your risk preferences might change as you progress through your career and get closer to retirement. Part of this process is determining what risks you are willing to take as you build up your retirement fund.

To assess your risk preferences, you must complete the following risk tolerance surveys/quizzes. The results will help you determine your risk tolerance level, as well as the composition of a portfolio of investments that is appropriate for your risk tolerance at this time of your life.

Time Value of Money Essay Paper

At the end of the questionnaire, you will see your ìrisk score.î Below the risk score will be a pie chart that shows the recommended allocation of your funds between stocks and bonds.

Calcxml.com: (1) take the risk tolerance quiz, named ìWhat is my risk tolerance,î which can be accessed at https://www.calcxml.com/do/inv08. Print the page that gives you the results of the quiz; and (2) take the quiz named ìHow should I allocate my assets,î which can be accessed at http://www.calcxml.com/calculators/inv01 (this link is also given in the area that reports the results for the risk tolerance quiz). Print the page that shows the pie chart with the recommended allocation of investments.

PsychTests: http://testyourself.psychtests.com/testid/2122

Money-Zine: http://www.money-zine.com/calculators/investment-calculators/asset-allocation-calculator/. The results give an indication of the recommended proportions that should be invested in each type of financial asset.

http://inflationdata.com/Inflation/Consumer_Price_Index/HistoricalCPI.aspx?reloaded=true

https://data.bls.gov/search/query/results?cx=013738036195919377644%3A6ih0hfrgl50&q=consumer+price+index

http://neatideas.com/cpi.htm

http://www.pan.ci.seattle.wa.us/financedepartment/cpi/forecast.htm (Click ìExcel Fileî under Annual U.S. CPI-U to get CPI estimates in spreadsheet form.)

This test takes about 20 minutes to complete. The results will give you a good idea of how you approach risk in general. Print the final page that contains the results.

You can access the quizzes by clicking the links given above. If clicking a link does not work, simply copy the link and paste it into the address line on your web browser. These risk tolerance quizzes will provide a good estimate of your tolerance for taking risk when investing. Be sure to print the results of each quiz you complete, because you must turn in a copy of the results for each quiz with your extra credit project. You can use your computerís print screen function (PrtScn key) to print the results of the quizzes.

- Retirement Goals. This is the most important part of the project. In this section, you must describe your retirement goals and determine how these goals can be achieved. You must (1) determine the amount of funds you will need at retirement to achieve the retirement goals you establish and (2) how much you should invest each year from graduation until retirement to ensure sufficient funds are available at retirement to meet your goals. In this part of the project you must develop the numerical details of your retirement plan. All computations must be completed using the spreadsheet template that is provided with the extra credit project (link: http://sbesley.myweb.usf.edu/FIN3403/retire-sp19.xls). If you do not use the spreadsheet for the computations, your project will not be graded (that is, you will receive a score of zero for the entire project). For this portion of the project, you must complete the following:

- Determine the average annual dollar amount that you expect to need during the years you are retiredóthat is, determine the average amount you want your retirement fund to ìpayî you each year during retirement so you can live the lifestyle you desire. You must explain how you determined the annual retirement income (amount) you selected is appropriate for your retirement plan. To estimate your financial needs/wants at retirement, first determine the average dollar amount you would need each year if you were retired today. To estimate the needed retirement income in terms of current dollars, you can talk with persons who are currently retiredóthat is, ask what their living expenses (housing, health, travel, and so forth) are and what amount of income they need to meet such expenses. After you estimate your retirement needs in terms of current dollars, you must translate the current dollars into dollars for the years (in the future) when you expect to be retired. To do so, you must consider the impact of inflation.

You can estimate future inflation by examining historical inflation rates. You can find information about the Consumer Price Index (CPI) and inflation rates at the following websites:

Once you estimate future inflation, translate your ìcurrent retirement dollarsî into future dollars (in the year you expect to retire) using the average inflation rate. In other words, when determining your income needs (withdrawals from your retirement fund) during your retirement years, you must consider the impact of inflation.

HINT: The second problem in the Time Value of MoneyóAssignment #1 that is posted on the course webpage shows how to adjust current values for expected inflation. The link to the problem is: http://sbesley.myweb.usf.edu/FIN3403/tvm-1.doc.

- Compute the total dollar amount your retirement fund must equal at the time you retire so that you can withdraw the amount you want to collect from your retirement fund each year as determined in Part A of this section. You should assume that the first withdrawal from your retirement account will be on the day you retire. For your computations, use an average rate of return (opportunity cost) for all the years you expect to withdraw funds from your retirement fund. Compute the average rate of return using the information provided at the beginning of Section IV of the spreadsheet template.

- Any funds you currently have invested for your retirement will decrease the future contributions that must be made to your retirement fund during your career to meet your retirement goals. As a result, if you currently have funds invested for retirement purposes, you must compute how much these funds will be worth (grow to) at the time you expect to retire so that you can determine the additional amount you must contribute to your retirement fund in the future to achieve your goals. For the computations in this section, assume the rate of return these funds earn is the average rate that is determined at the beginning of Section IV in the spreadsheet. If you currently have no funds invested for your retirement and you are 27 years old or under, for this assignment assume you actually have $3,800 already in a retirement fund; if you are older than 27 years, assume you have $6,900 invested in a retirement fund.

- Compute the annual contributions you must make to a retirement fund during your professional career to ensure your retirement fund accumulates the total amount needed at retirement. In this section, compute the annual contributions you must make during your career so that your retirement fund has the amount you specified in Part B of this section. You must consider the amount you currently have (or are assumed to have) invested in a retirement fund (Computed in Part C), because this amount will decrease the future contributions you must make to accomplish your retirement goals. For your computations, use an average rate of return for all of the years you expect to contribute to your retirement fund as the base-case scenario (see the beginning of Section IV of the spreadsheet template that is required for the project). Compute the contributions that are necessary based on estimates for the average return in three different markets a normal, or average, market, which is based on the expected returns given in Section IV of the spreadsheet, a lower-than-normal, or below-average, market, and a higher-than-normal, or above-average, market. The return you use for the above-average market should be 3 percent greater than the portfolio return given at the beginning of Section IV in the spreadsheet; the return you use for the below-average market should be 2 percent less than the portfolio return given in Section IV of the spreadsheet.

- Re-compute the contributions that are needed to accumulate the amount of funds required at retirement (computed in Section B) assuming you wait to begin making contributions to your retirement fund such that the number of payments you make (years) is only 60 percent of the years reported in Section II. In other words, if you expect that you will work for 40 years before retiring, re-compute the required retirement contributions using 24 yearsóthat is, assume you wait 16 years to start contributing to your retirement fund so that you have only 24 years remaining until you retire. For the computation in this portion of the project, follow the instructions given in Part D of this section. Compute the annual contributions that must be made to a retirement fund for the three different markets described in Part D.

- Re-compute Parts B ñ D in this section assuming that the amount you withdraw from your retirement fund each year during retirement is (i) $10,000 higher and (ii) $7,000 lower than the amount you established in Part A. For example, if you determined the amount that should be withdrawn from your retirement account each year after you retire is $50,000, (i) increase that amount to $60,000 and (ii) decrease that amount to $43,000 for the computations in this section. For this computation, assume that the number of years you contribute to the retirement fund is the same as you originally determined in Section II. Compute the contributions that would be needed in the three market conditions given in Part D of this section that is, compute the contributions that would be required in a normal, or average, market, a below-average market, and an above-average market.

- Discuss the feasibility of your retirement plan (Parts A-E of this section). Do you think the plan is attainable? You should consider the fact that you need some of the income you earn each year during your career to support your existing lifestyle and you must pay taxes. If your plan requires you to invest 80 percent of the annual income you estimated earlier (in Part I) in a retirement fund, then it clearly is not realistic.

- Find at least two published articles that address the issue of financial literacy in the United States. The articles must have appeared in print or online January 1, 2017 or later, and they should have been published by reputable sources, such as the New York Times, Money, CBS News, Fox News, and so forth. Briefly summarize the articles you choose and discuss actions that you think can be implemented to improve the financial literacy of Americans. Your discussion should be a minimum of 500 words in length (typed and double spaced) and a maximum of 800 words. You must turn in copies of the articles with the project. Make sure you reference (cite) any ideas you use in your discussions that are not your own thoughts.

IMPORTANT! READ CAREFULLY

1.It is a good idea to review the Time Value of MoneyóAssignment #1 that is posted on the course website at http://sbesley.myweb.usf.edu/FIN3403/tvm-1.doc. If you understand the two problems given in this assignment, you should be able to complete the extra credit project without much difficulty.

2.You should submit only three documents:

a.The Word template. You must use the Word template to provide your answers and discussions/explanations. Simply fill in the requested information on the form. Your project will not be graded (i.e., you will receive a score of zero for the entire project) if any other format is used. The pages that contain the required layout for the project are formatted so that you can easily fill in the spaces with the necessary information/discussions. You can use more space than is provided on the form for your discussions. The Word template is available at http://sbesley.myweb.usf.edu/FIN3403/retire%20template-sp19.docx.

b.The Excel spreadsheet template. You must use the spreadsheet template that has been created for the project to complete your computations. If you do not use the spreadsheet template or follow the instructions given, your project will not be graded (i.e., you will receive a score of zero for the entire project). You must use spreadsheet functions or set up equations in the appropriate cells to solve the computations required in the spreadsheet. Do not plug in any numbers where computations are required or where you should reference a number that is located in another cell in the spreadsheet; otherwise, you will lose valuable points (one point will be deducted for each instance where you enter numbers where either computations are required or you should reference the results from another cell in the spreadsheet). In other words, the appropriate computations should be completed in the spreadsheet, not on your calculator. If you input values (numbers) for all of your answers in the spreadsheet rather than using the appropriate functions or setting up equations to complete the computations, your grade on the project will be zero. The Excel template is available at http://sbesley.myweb.usf.edu/FIN3403/retire-sp19.xls.

c.A Word document or a PDF file that contains (i) the results of the life expectancy quizzes and the risk tolerance quizzes that you completed and (ii) copies of the articles you used to complete Part IV(H) of this project. You can use the print screen (PrtScn) function on your computer to capture an image of the results of the quizzes. You should place all of the results of the quizzes and copies of the articles in one document. If you do not attach copies of these quizzes, you will lose 1/2 point for each quiz that is missing.

We can write this or a similar paper for you! Simply fill the order form!