Distinguish among a sole proprietorship a partnership and a corporation delineate the advantages and disadvantage of each describes how the revenues profits liabilities and assets are shared

Order Instructions:

distinguish among a sole proprietorship a partnership and a corporation delineate the advantages and disadvantage of each describes how the revenues profits liabilities and assets are shared

SAMPLE ANSWER

Distinguish between a sole proprietorship a partnership and a corporation

Introduction

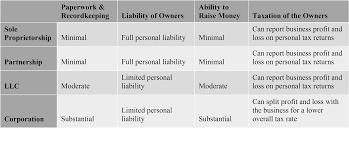

Sole proprietor engages in a business enterprise mostly as a single director as well as the owner. There are many advantages related with this kind of arrangement. The owner can make quick decisions without consulting anyone. He also shares his profits with no one and he can dissolve the business without consulting anyone. The major disadvantage is that there is no continuity in case of death and the business is not limited. The business cannot be sued or sue in its own name and the owner is personally liable for the debts of the company. The owner cannot also borrow money from the public (Chandra, 2007).

A partnership is also not limited and it can be formed by two or more persons but they should be less than fifty members or as stipulated by law. The partners share all the profits according to their own agreements. Partnerships are simple to create and manage. Partnership also has continuity as in the case of the death of a member the rest of the members can continue with the business. General partnerships have partners who are personally liable for any debts incurred from the business. Limited partnerships have limited liability to its members however it’s more expensive to create.

Corporations have legal personality and they can sue or be sued in their own names. They can also raise money from the public and they have limited liability. They are formed by two or more directors.

The major disadvantage is that they are taxed highly and the process of registering the corporation is longer and requires more money. The company must also publish its accounts annually. Companies declare dividends to the shareholders as profits from the company and which is distributed according to each shareholding. All dividends payable to the shareholders are also taxed.

References

Chandra, G. (2007) Company Law, 3rd Edition; McGraw-Hill Education

We can write this or a similar paper for you! Simply fill the order form!