AirAsia India Strategy Analysis

AirAsia India Strategy Analysis

Order Instructions:

SEE ATTACHED

SAMPLE ANSWER

AirAsia India Strategy Analysis Report

Introduction

Air Asia which operates globally entered the aviation industry as a low cost airline and it is headquartered in Kuala Lumpur, Malaysia. Its operations are through scheduled international and domestic flights and it is without any doubts the largest low fare airline in Asia and operates without frills which distinguish it as the pioneer of low cost flights in Asia (AirAsia, 2016a). According to AirAsia (2016b) AirAsia’s operations are mainly based at Kuala Lumpur International Airport (KLIA) within the Low Cost Carrier Terminal (LCCT) and it has other affiliate airlines either as subsidiaries or joint ventures such as Thai Air Asia, AirAsia X, Philippines’ AirAsia Inc., AirAsia Japan, Indonesia Air Asia and AirAsia India. The later airline i.e. AirAsia India, which is a subsidiary of AirAsia is the subject of discussion in this report.

The original founder of AirAsia was the Malaysian government, which established the airline in 1993 and it was later bought by Tony Fernandes and partners Pahamin Rejab (former AirAsia’s chairman), Aziz Bakar and Kamarudin Meranun on 2nd of December 2001 (AirAsia, 2016a). AirAsia has aggressively continued to spread out low cost travel through the management’s efficient, passionate and innovative approach to its current status whereby it has a route a network extending through more than 20 countries (AirAsia, 2016c).

Nowadays, AirAsia now is undoubtedly one of the largest low-cost and award winning airlines in the ASEAN and its growth and operations are expanding rapidly in the region. It airline started with a primary goal of ensuring that it frees air travel as well as making it so affordable to travel through the air in order to ultimately make sure that “now everyone can fly”. Currently, the airline as a whole operates a fleet consisting of 90 short-haul, medium-haul and long-haul aircrafts flying to over 60 destinations mainly from hubs in Malaysia, Indonesia, Thailand and India (AirAsia, 2016c). As a result, the airline operates over 3,500 flights on a weekly basis, thus coloring the Asian blue skies bright red alongside their livery striking. The airline also employs about 7,500 staff and within its short period of existence, AirAsia has managed to ferry approximately 90 million passengers to various destinations not only in Asia but also across the world (AirAsia, 2016a).

- Objectives

AirAsia objectives are targeted at making sure that that airline’s rapid growth and expansion as well as operational efficiencies are maintained. The objectives are:

- To achieve higher cost advantages by continuously reducing cost along its value chain through the analysis of the value chain to create cost benefits.

- To establish itself as the leading low-fares and no frills airline in the ASEAN region in order to increase its passenger traffic.

- To ensure that it maintains continuous improvements in service delivery as well as expansion of its operations in ASEAN region and globally.

3.0. Strategy and Answering the Key Questions

Business strategy of AirAsia put in place the foundations of the business, and the airline strives to deliver low-cost, no frill, reliable and hassle-free services and flights to its passengers. AirAsia’s low fare model is made possible for creation of values by implementing the key strategies highlighted below:

- Strategic Analysis

According to Homburg, Kuester & Krohmer (2014) strategic analysis involves careful assessment of the prevailing conditions that directly or indirectly influence the business in order to identify the imminent challenges or unfavorable factors as well as critical success or favorable factors. As a result, the strategic analysis will involve the PESTLE analysis, Porter’s five forces, value chain analysis and the SWOT analysis (Porter, 2012). The strategic analysis is imperative for a business since it is vital in the identification of critical success factors which AirAsia should leverage on to achieve competitive advantage in the aviation market (Kotler & Armstrong, 2012; Porter, 2013).

- PESTLE Analysis

PESTLE analysis is essential in ensuring that there is assessment of the company’s situation in terms of politics, economics, socio-cultural factors, technology, as well as legal and environmental factors aimed at determining a company’s long-term plans (Barney, 2011; Baker, 2013). Thus, the discussion will consider political, economic, social, technology, legal as well as environmental factors as discussed in the section that follows below.

Political

Politically, it was without any doubts difficult to fly within the ASEAN region making the airline to undertake a process of addressing the main barriers towards low cost travel through the double-sided agreement. According to Saha & Theingi (2013) in terms of politics, the landing charges are also envisaged to be a significant factor that will influence low fare airlines charges. There are also other political factors that influence AirAsia operations in India including: government support for the national airline carriers within the region, increased charges in the routes by the government; severe security restrictions and measures in the region; threat of terrorism attacks in the region; increased tensions between various countries in the country including Indonesia and Malaysia as well as the newly established “climate protection charge” for the compensation of carbon emission taxes by the aviation industry.

- Economic

AirAsia airline plays an imperative role in ASEAN aviation market by offering low-cost flights through provision of inexpensive tickets as well as significant reduction in flight services. Through the cheap fares, the airline is likely to achieve competitive advantage in the market over its competitors irrespective of the economic situation (Kotler & Armstrong, 2012). Other economic situations that characterize the Indian aviation market include fluctuations in the currency, high prices of the petroleum fuels and/or products, economic recessions or sluggish GDP growth rates, the low cost airline industry in India is within the growth rate life cycle and finally the changes in the economy are attributed to variations in lifestyles including increased frequency in flying for vacations.

Social

Socially, the willingness of passengers in the region to take the long-haul flights which are significantly expensive is very minimal. There is also an increase in the global population as well as the middle class both of which have increased demand for air travel in the ASEAN region including for AirAsia (AirAsia, 2016b). Operations within the ASEAN region are also characterized by a variety of languages and cultures, whereby the grey market associated to this phenomenon is attributed to the rapid growth in the company’s operations (Kotler & Armstrong, 2012).

- Technology

The availability of advanced technologies for AirAsia have been critical in ensuring that the airline provides online services that are essential at combining air ticketing, travel insurance, hotel bookings as well as car hire. According to Armstrong & Greene (2013) the airline has significantly pushed on the internet booking services in its attempts towards keeping operational costs in check.

- Legal

Considering that long haul flights shall be offered by AirAsia Indian through its strategic alliances with a variety of airlines, the potential for expansion of its operations is likely to take place through further partnerships aimed at more liberalization of the services (Reicheld, 2012). Due to the fact that, commercial aircrafts have to fly a variety of countries this means that the greatest legal hurdle is to obtain clearance by the respective territories and/or countries to allow the company aircrafts fly over their skies. Thus, the AirAsia’s external environment is relatively stable as long as there is steady maintenance of the legal environment which is also critical in determining the consumer behavior (Schiffman et al., 2009).

- Environmental

The ASEAN region, rapid population and economic growth have been attributed to creation of serious social consequences that have negative influence of the environment including air pollution and global warming. There is a constant increase in the rate of air travel within the ASEAN region as better technologies motivates more customers to travel; and this has been attributed to an increase in the number of issues related to green house gas and global warming effects (Saha & Theingi, 2013).

- Porter’s Five Forces

Porter’s five forces is a model used by many companies particularly in their marketing strategy in order to conduct industry analysis as well as corporate strategy development. The model includes five key factors such as competition, supplier strength, customer power, and the potential for new entrants into the market as well as threat of substitute products (Armstrong & Greene, 2013).

Figure 1: Porter 5 Forces diagram

- Bargaining power of customers

Buyers’ bargaining power has definite ability to put a company under pressure from its own customers (Saha & Theingi, 2013). There are 2 types of buyer power which are customer’s price sensitivity and negotiating power and price sensitivity by customers are the two main types of buyer power; hence the Revenue Management System was immensely utilized by AirAsia in almost all its operations thereby helping it to react to customer behavior to maximize on income. The availability of seats is availed at various prices in varied points of time and the charging for reservations is done upon the changing of the previous booking time by the customer to later or earlier day (Lamb, 2014; Porters, 2013).

- Bargaining power of suppliers

Bargaining power of suppliers is imperative in describing the market input thereby acting for the benefit or detriment of the company (Mulcaster, 2013). To overcome the challenges posed by the high suppliers’ bargaining power, AirAsia adopted a full fledged ERP system to ensure reductions in the financial month-end times for closing processing, retaining process incorruptness, as well as speeding up data restoration and reporting process (Saha & Theingi, 2013)

- Threat of new entrants

Threat of new entrants in the market is critical in determining the market profitability subsequently giving high return as well as attracting the new firms (Saha & Theingi, 2013). However, the barrier to entering the airline industry is significantly high due to the high capital required to rent or purchase the aircrafts, hire employees, set up an office etc (Lamb, 2014).

Threat of substitutes

Threat of substitute is attributed to the availability of products that increase the propensity of customers to switch or shift to alternatives and/or options (Saha & Theingi, 2013). The threat of substitutes for AirAsia in the ASEAN region is minimal, including busses, train and cruise due to the geographical factor.

- Rivalry among existing competitors

For the aviation industry, the intensity of competitive rivalry is without any doubts the main determinant of the industry’s competitiveness (Kotler & Armstrong, G. (2012). The main competitors of AirAsia Indian in the Indian aviation market are Nacil, Jetlite, Air Sahara, Air Deccan, Jet Airways, Kingfisher, Spice Jet, Go Air, Indigo, Paramount and Jet Konnect. However, through its unique services AirAsia has managed to overcome its competitors to emerge as the leader in low-cost travel airline in the ASEAN region.

- Value Chain

Value chain is a critical part of a company’s operations which is involved in converting inputs into outputs in the process of adding to the bottom line and also helping in the creation of competitive advantage in the market (Mintzberg, Ahlstrand & Lampel, 2014). The value chain of a company involves a wide range of activities and AirAsia’s value chain can be mainly divided into two main activities such as primary and supportive activities. The primary activities in AirAsia’s value chain are mainly concerned with logistical issues and usually involve the inbound logistics, outbound logistics, sales and marketing as well as services. On the other hand, the supportive activities in AirAsia’s value chain are usually concerned with the firm infrastructure, human resource management as well as technology. According to Kotler & Armstrong (2012) a balanced combination of these two operational activities which are critical for day to day operations of the company is essential in ensuring that optimal returns are achieved.

Barney (2011) notes that primary activities are without any doubt the most vital in making sure that the operations of a company take place in the respective markets effectively. In particular, the inbound logistics of AirAsia include activities such as appropriate management or progress of flights, keeping an eye on the competitors in the market as well as consistently assessing the ways through which low cost prices can be maintained through fuel efficiency control especially by advance purchase of fuel when the prices are low alongside effective planning of routes (AirAsia, 2016c). Alternatively, the outbound logistics of AirAsia are often carried out through an online platform which is used to enable customers to access online booking in order to get their air tickets. This is highly important because it helps customer to book their air tickets conveniently or print them prior to arriving at the airport (Gregson, 2014; Gronroos, 2014). Additionally, general electric engines are the ones used by AirAsia due to their reliability in order to ensure customer safety mainly because the company prioritizes their customers. AirAsia also has an edge due to its strong brand name which plays a critical role in its marketing strategy because it is attributable to a significant extent of the company success in the Indian aviation market through significant market collision as well as increased sales (Cameron, 2014; Deming, 2012). As a result, due to AirAsia’s marketing it has been sponsoring the mu football club as well as the amazing race tournament. In addition, some of the company’s aircrafts are usually painted with sports stars and club color, while a significant amount of merchandise related to AirAsia including T-shirts and caps are produced every year (AirAsia, 2016c). Services are the other form of outbound activities, and AirAsia is undisputedly involved in the delivery of a wide range of services to its customers such as pre-booking checked baggage at lower rates and offering e-gifts on flights that are delayed more than three hours as well as online medical services, renting a car and booking of hotels (AirAsia, 2016a).

Furthermore, AirAsia’s value chain provides supportive activities for the purpose of making sure that the business remains operational. The airline is not only concerned with offering classic low-cost flights due to its low-cost carrier (LCC) status but also it is advancing into ensuring that it becomes an integrated airline service provider. Thus, AirAsia is usually focused in making sure that it provides cheap fare travel as well as exploring new markets (AirAsia, 2016a). According to Shaw (2012) human resources management is an imperative function in ensuring company activities are supported. According to Nagle & Holden (2012) managing operational costs is essential in ensuring that the performance of employees is compensated. Finally, technology has been a critical component of AirAsia’s operations and a variety of technologies have been adopted by the airline in order to make operations efficient and easier and also minimize the cost (Lamb, 2014; Porters, 2013). For instance, AirAsia particularly uses the YMS, CRS and ERP technologies whereby they are used for accounting for the operational costs and expected revenues, to aid direct sales through web-based inventory and reservation system, as well as helping to save time and speeding up data restoration and reporting process respectively (AirAsia, 2016c).

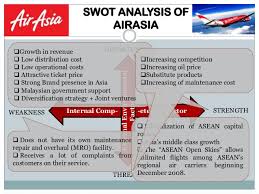

- SWOT Analysis

SWOT analysis is without any doubts the most significant business strategy tool used for the analysis of the internal environment of the business or company (Besanko et al., 2014). The SWOT Analysis is majorly concerned with the identification of the business’s strengths, weaknesses, opportunities as well as threats both at organizational and operational/managerial level. As a result, the SWOT Analysis covers both the external and internal factors that are likely to influence its success (Mulcaster, 2013). Thus, in this section the strengths, weaknesses, opportunities as well as threats of AirAsia shall be discussed in details to ensure that the specific position of the company is determined (Kevint, 2013; Monroe, 2013).

- Strengths

With regards to the strengths of the airline, AirAsia has ensured that it maintains low costs in its operations and maintenance mainly through the change of the aircrafts from Boeing 737 to A 320 particularly in Indonesia and Thailand. Besides, AirAsia India maintaining low operational cost as a result of the existing online reservation system, other strengths include no frills, quick checked in etc. considering the Indian aviation market there is a significantly untapped market which gives AirAsia an upper hand to penetrate and subsequently stimulating to potential markets. The other strengths of the airline company include adoption of a flat organizational structure in order to ensure aggressive, effective and focused management; efficient and/or multi skilled staff; strong brand recognition; leader in IT by being a frontrunner in implementing IT solutions within the aviation industry making the airline to be an ICT Award winning airline company; and also maintaining a single model of aircrafts is very critical in ensuring significant reductions in maintenance fees are achieved.

In addition, the AirAsia’s website attracts above 20 million viewers on a monthly basis due to its multilingual status meaning that the translation of its messages whether in the airline’s original website, Facebook account, or Twitter handle are powerful marketing tools (Monroe, 2013). Moreover, strategic alliance partnership as well as joint ventures with varied airline companies is the other strength of AirAsia mainly due to the fact that that it allows acquisition of more market share by the company subsequent to the attainment of more brand recognition (AirAsia, 2016c). The no frills strategy is difficult to achieve for long-haul flights despite the fact that the flight time for passengers is either less or more than two and a half hours (AirAsia, 2016a).

- Weaknesses

The weaknesses of AirAsia are minimal; however, due to significantly huge investments in the acquisition or aircrafts as well as implementation of modern technologies mainly through outsourcing, there is a considerable increase in the airline’s operating costs. In addition, the AirAsia usually offer not more than 15 kilograms of luggage allowance making it less competitive compared to other airlines in the same market that offer a higher but luggage allowance (AirAsia, 2016c). Furthermore, the services of the company are not optimal hence they pose other several weaknesses including limitation of service resources by lower costs; lack of centrality in the secondary airports’ location; lack of repair or maintenance facility for the AirAsia’s fleet, new market entrants are envisaged to provide services that are sensitive to prices; government interference on passenger compensations and regulation on airport deals; and finally the large number of complaints raised by customers, especially among the passengers with disabilities since limited services are offered to this group of customers (Laermer & Simmons, 2013).

- Opportunities

For the opportunities of AirAsia, the airline should capitalize on offering low fares which are critical in encouraging people drawn from diverse walks of life to travel through the air. In addition, by embracing A320 which is more efficient to operate is essential in the stimulation of superior numbers as well as services to the passengers (AirAsia, 2016a). As a result, of the airline’s adoption of technology there is a possible opportunity in introducing booking of the flights through SMS thereby allowing anytime and every time booking of the seats in the aircraft prior to security scrutiny which has been critical in making sure that AirAsia flights are successful.

- Threats

Finally, the threats of AirAsia are numerous but if they are effectively managed the company has the potential to continue making profits. The specific threats associated with the operations of AirAsia India include: the full service airlines not only in India but the ASEAN region as a whole have began lowering their prices in their attempts towards competing with low-cost carriers (LLCs) meaning that the entrance of other low-cost carriers (LLCs) is a threat to AirAsia India. Moreover, high fuel prices as well as the government policy and aviation regulation tend to vary across countries and regions (Mintzberg, Ahlstrand & Lampel, 2014). Additionally, there are also other factors which pose threats to the operations of AirAsia Indian including legal constraints that specifically affects strategic alliance across various countries; negative influence of customer confidence due to probable terrorist attack, accident as well as natural disasters; and finally the increased cost of operational costs in the production of value added aviation services (AirAsia, 2016c).

- Strategic Choices

According to Hill, Gareth & Jones (2012) strategy formulation which is concerned with strategy choices involves the process of the selection of the most appropriate combination of actions aimed at ensuring that the goals and objectives of the organization are achieved. The process of choosing the appropriate strategic choice for AirAsia India follows the Porter’s generic model which involves 6 steps which such as setting organization’s objectives, evaluation of the environment of the business and/or organization, setting quantitative targets, aiming with divisional plans, analysis of the performance and ultimately selecting the choice of strategy (Homburg, Kuester & Krohmer, 2014). However, the Porter’s generic model is customized for the AirAsia into three key strategies such as the cost leadership, differentiation and focus.

The strategic choices are informed by the increasing middle class, GDP as well as population in India according to World Bank and Euromonitor International forecasts. As a result, the available actions include more expansion into the Indian and Chinese aviation market as well as developing cargo services. Each of these strategic choices poses a variety of benefits as well as detriments customers (Laermer & Simmons, 2013).

- Recommended Plan of Action

Considering the prevailing conditions the Indian aviation market more expansion in the Indian market is the most appropriate since it will help the company to gain competitive advantage with its competitors such as IndiGo, GoAir, SpiceJet in that region and gain more economic of scale. This will include increasing the company revenues by a 20 per cent, number of passenger by 30 per cent as well as fleet number and length by 10 per cent.

- Conclusions

After looking at above analysis the recommended strategy for AirAsia in the Indian aviation market is the expansion of its low-cost long haul flights further in China and the far regions of India. However, the company should consider aggressive expansion to the country. This is attributable to the rising middle class and population in the two countries as well as tourist attraction and being the biggest contributor to the world GPD growth by 2017 offers huge opportunities for AirAsia.

References

AirAsia (2016a). About Us. Retrieved January 2, 2016, from http://www.airasia.com/ot/en/about-us/hi-we-are-airasia.page

AirAsia (2016b). AirAsia India Organizational Structure. Retrieved January 2, 2016, from http://www.airasia.com/ot/en/about-us/airasia-india-organizational-structure.page

AirAsia (2016c). Company Profile. Retrieved January 2, 2016, from http://www.airasia.com/site/au/en/page.jsp?name=Company+Profile&id=261a884e-ac1e00ae-edd9de00-4fe3279d&nav=5-0

Armstrong, J. S., & Greene, K. C. (2013). Competitor-oriented Objectives: The Myth of Market Share. International Journal of Business, 12(1), 116–134.

Baker, M. (2013). The Strategic Marketing Plan Audit. New York, NY: Prentice-Hall.

Barney, J. (2011). Firm Resources and Sustainable Competitive Advantage. Journal of Management, 17(1), 132-141.

Besanko, D., Dranove, D., Schaefer, S. & Shanley, M. (2012). Economics of Strategy. Hoboken, NJ: John Wiley & Sons.

Cameron, B. T. (2014). Using responsive evaluation in Strategic Management. Strategic Leadership Review, 4(2), 22-27.

Deming, W. E. (2012). Quality, Productivity and Competitive Position. Cambridge, MA: MIT Center for Advanced Engineering.

Gregson, A. (2014). Pricing Strategies for Small Business. London, UK: Self Counsel Press.

Gronroos, C. (2014). From marketing mix to relationship marketing: towards a paradigm shift in marketing. Management Decision, 32(2), 4–32.

Hill, C., Gareth, W. L., & Jones, R. (2012). Strategic Management Theory: An Integrated Approach, (10th ed.). New York, NY: Cengage Learning.

Homburg, C., Kuester, S., & Krohmer, H. (2014). Marketing Management: A Contemporary Perspective. London, UK: CRS Press.

Kotler, P., & Armstrong, G. (2012). Principles of Marketing, (13th ed.). New York, NY: Pearson Prentice Hall.

Kvint, V. (2013). The Global Emerging Market: Strategic Management and Economics. New York, NY: Routeledge.

Laermer, R., & Simmons, M. (2013). Punk Marketing. New York, NY: Harper Collins.

Lamb, R. B. (2014). Competitive strategic management. Englewood Cliffs, NJ: Prentice-Hall.

Mintzberg, H., Ahlstrand, B., & Lampel, J. (2014). Strategy Safari: A Guided Tour through the Wilds of Strategic Management. New York, NY: The Free Press.

Monroe, K. B. (2013). The Pricing Strategy Audit. Cambridge, MA: Cambridge Strategy Publications.

Mulcaster, W. R. (2013). Three Strategic Frameworks. Business Strategy Series, 10(1), 68 – 75.

Nagle, T., & Holden, R. (2012). The Strategy and Tactics of Pricing. New York, NY: Prentice Hall.

Porter, M. E. (2012). Competitive Strategy. New York, NY: The Free Press.

Porter, M. E. (2013). Competitive Advantage. New York, NY: The Free Press.

Reichheld, F. (2012). The Loyalty Effect. Boston, MA: Harvard Business School Press.

Saha, G. C. & Theingi, S. (2013). Service quality, satisfaction, and behavioral intentions: A study of low-cost airline carriers in Thailand. Managing Service Quality, 19(3), 350-372.

Schiffman, L., Bednall, D., O’Cass, A., Paladino, A., Ward, S. & Kanuk, L. (2008). Consumer Behavior, (4th ed.). NSW, Australia: Pearson Education Australia.

Shaw, E. (2012). Marketing strategy: From the origin of the concept to the development of a conceptual framework. Journal of Historical Research in Marketing, 4(1), 30–55.

We can write this or a similar paper for you! Simply fill the order form!