Currency Swaps

Will Currency Swaps Result in Low Financing Costs?

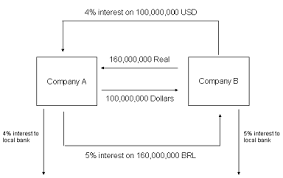

POINT: Yes. Currency swaps have created greater participation by firms that need to exchange their currencies in the future. Thus, firms that finance in a low interest rate currency can more easily establish an agreement to obtain the currency that has the low interest rate.

COUNTER-POINT: No. Currency swap will establish an exchange rate that is based on market forces. If a forward rate exists for a future period, the swap rate should be somewhat similar to the forward rate. If it was not as attractive as the forward rate, the participants would use the forward market instead. If a forward market does not exist for the currency, the swap rate should still reflect market forces. The exchange rate at which a low-interest currency could be purchased will be higher than the prevailing spot rate, since otherwise MNCs would borrow the low-interest currency and simultaneously purchase the currency forward so that they could hedge their future interest payments.

We can write this or a similar paper for you! Simply fill the order form!