Depreciation Concept

Depreciation Concept

Order Instructions:

This week 4 assignment is actually due on sunday. So please do it as fast as possible. Please use the same health care finance book.

SAMPLE ANSWER

Assignment Week 4

Assignment Exercise 8-3: Depreciation Concept

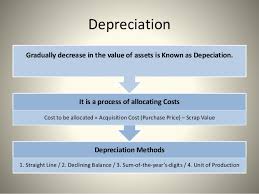

As expected, an asset will decline in value over a given period of time depending on several factors (Baker & Baker, 2013). However, the amount of depreciation will differ based on the type of method used. In this case, the two purchased equipment in MHS will have different depreciating values when the straight line and the double-declining balance depreciation methods are used as demonstrated below.

The Straight Line Depreciation

MHS’s Lab Equipment

| Year | Annual Depreciation | Remaining Balance |

| Beginning Balance = | $300,000 | |

| 1 | 57,000 | 228000 |

| 2 | 57,000 | 171000 |

| 3 | 57,000 | 114000 |

| 4 | 57,000 | 57000 |

| 5 | 57,000 | 0 |

Depreciation will not be deducted from the beginning balance but the remaining balance after removing the 5% salvage cost.

300,000 * 95% = $ 285,000

$ 285,000 will then be divided by 5 years to get an equal amount of the depreciating value.

MHS’S Radiology Equipment

| Year | Annual Depreciation | Remaining Balance |

| Beginning Balance = | $800,000 | |

| 1 | 102857.14 | 617142.86 |

| 2 | 102857.14 | 514285.72 |

| 3 | 102857.14 | 411428.58 |

| 4 | 102857.14 | 308571.44 |

| 5 | 102857.14 | 205714.3 |

| 6 | 102857.14 | 102857.16 |

| 7 | 102857.14 | 0 |

If the salvage value is salvage value (10%) the depreciating amount will be 90% * 8000 = 720000

The Double-decline Balance Depreciation

MHS’s Lab Equipment

In this case, 95% will be divided by 5 years to give 19% which will then be doubled to 38%. The 38% will be multiplied by the remaining depreciating balance of $285,000. However, this method will have the last two years will use the straight line method (Droms & Wright, 2015). Therefore;

| Year | Annual Depreciation | Remaining Balance |

| Beginning Balance = | $300,000 | |

| 1 | 108300 | 176700 |

| 2 | 67146 | 109554 |

| 3 | 41,630.52 | 67923.48 |

| 4 | 33961.74 | 33961.74 |

| 5 | 33961.74 | 0 |

MHS’S Radiology Equipment

90% of the remaining balance divided by 7 years will give 12.86% which is then doubled to 25.71% and used as the multiplying factor. Therefore;

| Year | Annual Depreciation | Remaining Balance |

| Beginning Balance = | $800,000 | |

| 1 | 187200 | 532800 |

| 2 | 138528 | 394272 |

| 3 | 102510.72 | 291761.28 |

| 4 | 75857.93 | 215903.35 |

| 5 | 56134.87 | 159768.48 |

| 6 | 79884.24 | 79884.24 |

| 7 | 79884.24 | 0 |

References

Baker, J. J., & Baker, R. W. (2013). Health care finance. Jones & Bartlett Publishers.

Droms, W. G., & Wright, J. O. (2015). Finance and accounting for nonfinancial managers: All the basics you need to know. Basic Books.

We can write this or a similar paper for you! Simply fill the order form!