Independent and CSR disclosure

Independent and CSR disclosure

Order Instructions:

Marking criteria

Maximum marks

a) Relevance of studies/ research papers cited- 3marks

b) Adequacy of studies / research papers cited -2 marks

c) Identification of theories/ concepts- 5 marks

d)Ability to identify key items in the literature: compare contrast-5 marks

e) Critical review of key items- summarise what is known strengths and limitations, gaps in the literature/ theory-10 marks

f) English- grammar, spelling, referencing-5marks

Total= 30

Kindly use the above marking criteria to prepare the literature review. Be sure the literature review is prepared as per marking criteria as this is a very very important assignment.

SAMPLE ANSWER

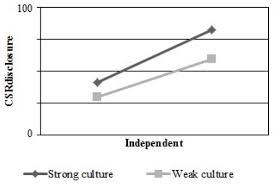

Independent and CSR disclosure relationship

The likelihood of a relationship with real money related torment to get changed evaluators will mostly be lower in case the audit board will be much higher. The exposures propose that the self-principle of the audit driving social occasion of trustees may influence the objectivity and shot of the outside evaluator (Wells & Ingley, 2015). By having the head of overview consultative assembling free of the alliance, the essential accumulation of trustees can enough screen the execution of the connection and result in enhanced corporate execution and exposure. Past studies have shown that review consultative party expects an affecting part in redesigning the corporate association benchmarks. Outline board union is tirelessly identified with budgetary reporting and sponsorship for the relationship between the zone of a review and more showed money related reporting (Haldar & Mishra, 2015). The area of an audit managing get-together was in a general sense and positively related to the level of decided presentation. Audit driving array of trustees expect a gigantic part in giving a mean to the blueprint of the company’s frameworks in term of going on cash related data and its inside control, as necessities be its district is in making first rate budgetary reporting (Davis & Lukomnik, 2013).. The barricade should set an audit board with no under three self-speaking to officials or more. The area of the survey consultative social event with a larger amount of free chief should diminish the workplace cost and upgrade within control that will prompt more unmistakable nature (Valmohammadi, 2014).

Board size and CSR disclosure relationship

The case information contains 54 relationships from sustainability disclosure in a Malaysian Environment as well as the corporate governance reporting. This is in light of the way that just 64 affiliations that consolidated into these two regard in Malaysian open recorded affiliations. Along these lines, this concentrate additionally takes 64 general relationships from the Global Reporting Initiative (Wolf, 2014). The master picks 2011 in light of the way that; that year the latest information open when the examination started. The last blueprints contain 130 affiliations (54 Malaysian Companies and 76 kenya relationship) as the rest were denied for two reasons, to be specific the openness of information and money part. At regardless, there are two affiliations that don’t have the information for the picked period. Second, there are two affiliations which are in the point of interest range (Gulzar & Wang, 2010). These relationships, in the purpose of premium part are banned in connection of the refinements in the bits of their monetary proclamations concerning the non-money divisions (Adiloglu & Vuran, 2012). This is more key to guarantee a high consistency in then study as a matter of fundamental extent. The affiliations consolidate acouple of fundamental extents or business winds, for case, buy things, moved things, exchanging and affiliations, money, progress, properties and lodgings (Sun, Salama, Hussainey & Habbash, 2010).

Significant relations that exist between CEO’S duality and CSR disclosure

The owners of many companies in Malaysia as well as in Kenya under the voluntary exposure and statistically significant in all annual reports that were found from both Malaysia and Kenya. Voluntary disclosure is defined as the shares that accompany is not moved in hands of few and expansive shareholders and prevent other s from having access to it (Galbreath, 2011). Most of the many shareholders are having small portions of the company shares and it is very important for all the companies to employ then use of public accountability due to the fact that they are held accountable to the public at large. Public accountability help in making sure that all the information is made clear and open for all to view all the operations of the company that are taking lace and how their money is spent (Rodrigue, 2014). What the company shareholders have is termed as then ownership concentration that has to be highly considered in making sure that all operations take place as required. The level of corporate governance is guided to ensure that then shareholders property in the company is well protected to then benefit of both then shareholders as well as the company at large (Dragomir, 2013). The voluntary exposures are negatively affected by the government ownership while on the other side the institutional as well as the shareholder ownership done not affect the level of voluntary disclosures (Sanan, 2011).

Significant relationship between CSR disclosure and audit committee

CEO duality

The role of duality is a potential impact on disclosure not common among the listed companies of study and testing has to be well done on it accordingly to give then desired results. All the separate roles that are given to the chair and chief executive are well highlighted to enhance monitoring of quality and decrease all the advantages that are gained when information is withheld (Del Baldo, 2012). The quality if reporting is well improved under such circumstances. All the relationship that exists between the corporate governance is well examined through focusing on disclosure of share of option. When the same person is aid to hold both the CEO and board chairman positions CEO duality is said to exist. A person will get greater power from any company that employs the use of CEO duality (Rahim & Alam, 2014). The shareholder wealth is well maximised where a company employs the use of a better CEO duality in their premises. Monitoring quality of the company will as well be improved and information will not be withheld as it used to be before such implementations were it in place (Porter & Miles, 2013).

Table 1: Statistics of most Malaysian companies. (Source: Rahim & Alam, 2014)

| N | Minimum | Maximum | Mean | Std. Deviation | |

| Disclosure Index | 50 | 37 | 43 | 41.00 | 1.301 |

| Board size | 50 | 6 | 21 | 11.15 | 2.134 |

| Board Independent | 50 | 11.00 | 91.68 | 44.4360 | 13.23456 |

| Role Duality | 50 | 0 | 1 | 0.31 | 0.123 |

| Audit Committee | 50 | 0 | 1 | 0.21 | 0.234 |

| Ownership concentration | 50 | 1.05 | 77.58 | 24.6172 | 15.23456 |

| Total Assets | 50 | 514.00 | 2630294.00 | 124226.7871 | 3.09876E5 |

| Leverage | 50 | 0.12 | 2.34 | 0.4890 | 0.45678 |

| Valid N | 50 | ||||

Table 2: Corporate Social Responsibility Statistical Disclosure (Source: Aktas, Kayalidere & Kargin, 2013)

| The theme | N | Mean

|

|

Std Deviation | Minimum

|

Maximum |

| The environment | 8 | 56.2 | 79.5 | 30.4 31.2 | 5.4 4.3 | 90.0 90.0 |

| Community Involvement | 11 | 33.5 | 82.6 | 15.7 13.5 | 32.5 49.0 | 90.0 90.0 |

| Human resources | 13 | 54.2 | 92.5 | 39.4 16.3 | 10.7 10.3 | 90.0 90.0 |

| Product and services | 8 | 64.4 | 90.7 | 32.5 12.2 | 5.2 29.2 | 90.0 90.0 |

| Total |

Measurement of Variables

The whole yearly report is inspected before any choice is made with a specific end goal to guarantee that judgements of hugeness is not uneven, which is according to the recommendation and practice (Peters & Romi, 2014). A summary included 39 corporate presentation things covering on five subjects (natural, pro, assembling, thing and quality included) were revealed (Allegrini & Greco, 2013). Correlation analysis can be used to determine the strength and direction of liner relationship (Michelon & Parbonetti, 2012). The table below has given all the correlation report between variables and regression for Malaysian and Kenyan companies (Anuchitworawong, 2010). Some of the variables were found to be more significant, but with negative correlations which is the CSR disclosure Index and ownership concentration (Mishra & Mohanty, 2014).. There was a negative correlation that existed between CSR disclosure Index and ownership concentration while on the other side there proved to be positive relation between role of independent and role of duality (Cormier & Magnan, 2014).

Figure 3: Multiple Regression Analysis. (Source: Chan, Watson & Woodliff, 2014)

| Year 2011 | Beta | t | Sig. |

| The (Constant) | -0.065 | 0.865 | |

| Kenya the Characteristics | |||

| Company board Size the (B-Size) | .324 | 2.454 | 0.100 |

| Role of Independent the (NED) | 0.34 | 2.011 | 0.032 |

| Role of Duality

(DUALITY) |

0.697 | 0.432 | |

| Chairman of audit committee (CHAIREC) | 0.35 | 0.435 | 0.445 |

| Ownership concentration | -.234 | -1.302 | 0.013 |

| Control Variables | |||

| Total Asset (T-Asset) | -.134 | ||

| Leverage (LEV) | -.56 | ||

| Model | |||

| Model Summary | |||

| R-Squared | 0.234 | ||

| Adjusted R-Sguared | 0.123 | ||

| F-Statistics | 7.123 | ||

| p-value | 0.00 |

The relationship that exists between the corporate connection trademark, corporate execution and CSR presentation are all around broke down under the usage of three sorts of variables has been analysed in the above section (Okongwu, Morimoto & Lauras, 2013). The self-controlling variables fused the corporate connection trademark, for occasion, board size, board free, some bit of duality, head of overview reprimanding gathering, and proprietorship focus and corporate execution was measured through the use of Return on Asset and Return on Quality (Burnett, Skousen & Wright, 2011).

Corporate social responsibility (CSR) and sensibility reports are constantly snatching vitality exhaustive as stakeholders concerns have connected past standard money related considerations to matters, for example, security and wellbeing moreover the effect of relationship on nature and the get-together (Habib-Uz-Zaman, 2010). The present globalization slant and making eagerness from accessories toward relationship in getting a handle on corporate social obligation (CSR) sharpens have drawn on the relationship of relationship in CSR hones CSR could be a general clarification which could show an association’s devotion to use its exchange related assets out the business sharpens with a particular deciding objective to give and add to its inside and outside partners (Mallin, Michelon & Raggi, 2013). In the prior decade, Malaysia has experienced an immense monetary and social changes that have been of greater use to then whole country and its people in large. Henceforth, the business environment has likewise wound up being all the more bewildering and inquiring. Corporate social obligation has been one of the making issues that in enterprisingly standing up to pushed relationship in Malaysia moreover all around. Corporate social obligation goes about as a part to enhance the affiliations picture (Luu, 2014). The whole prosperity is related to the cash reporting structure, that mirrors the society’s all the more wide yearning for of the bit of the business bunch in the economy. Corporate social obligation that is based in Malaysia ordinarily relates particularly to another organisation named Bursa Malaysisa organizing on recorded affiliations (Ben, 2014). All open recorded affiliations are required to reveal data identifying with their corporate social commitment hones in their affiliations. CSR structure delineated social obligation as an open and coordinate business sharpens, which relies on upon all the important qualities on upon fabulous values and respect for the get-together, doles out, environment, shareholders and contrasting shareholders (Lopatta & Kaspereit, 2014).

Discussion and Conclusion

Outcomes have found the capacity of all the aggregate presentation was just 14.5%, the Malaysian affiliations revealed just 81.2% of the general things in their disclosure instead of the general affiliations which uncovered around 89.7 %. The limit for the earth point was around 14.6%, pack cementing 7.1%, HR 37.5%, and things and affiliations 20.5%. It was nearby set up that The Malaysian affiliations have still addressed, they’re the best introduction for reliably and every one of the affiliations had uncovered their corporate social commitment presentation (Kaya & Aslan, 2013). The most stunning subject uncovered by the Malaysia affiliations was the gathering joining point (92.1 for each penny), trailed by the things and affiliations topic (81.1 for every penny); the earth point (71.1 penny), and the HR subject (63.5 for every penny). For general affiliations, the most lifted point was the social affair commitment subject (91.4 for every penny), trailed by the things and affiliations topic (88.9per penny); the HR subjects (89.7 for each penny) and environment subject (76.4 for each penny). With a specific end goal to find the relationship that existed between the corporate qualities and CSR presentation hypotheses were evident in the study. Results from the specific break conviction examination have shown that three hypotheses were seen taking after to there were administrator relationship between the board size, board free, and proprietorship center with CSR presentation(Kathyayini, Tilt, & Lester, 2012). The present study has shown that the measure of director in the board did thoroughly influence the CSR presentation. As the general affiliations more titanic driving get-together of executives size would make it all the more clear to control the CEO and the watching system would be all the all the all the all the likewise affecting(Harp, Myring and Shortridge, 2014). Sheets with more than seven or eight people were seen to be at danger to be practical, especially for the general affiliations withdrew and the Malaysian affiliations.. In association of the pulling in bits of taking in, the degrees of NED in the Malaysian and general affiliations were seen to be completely exceptional as by a long shot a large portion of the affiliations have no not a level of boss. Right when the level of free, non-official supervisor in the Malaysian and general affiliations were higher, the affiliations expected that would have better results. It was in light of the way that the free boss could perceive a key part in overhauling the corporate picture. Furthermore, the free boss could in like course, go about as an observing part in guaranteeing that the association was genuinely coordinated by its connection. In like manner, proprietorship fixation was found to have an enormous association with the CSR presentation. There were some findings that were collected for both Malaysin companies as well as those in Kenya and demonstrated a higher mean rate as a show of propsperity on proprietorship fixation which was 66.9% showed up, especially in relationship with the general affiliations which was just 32.4%. Both the Malaysian and general affiliations ought to have more concentrate on proprietorship fixation on the grounds that the concentrated possession could give a region to control the work environment issue through the strategy of the alliance and shareholders‟ leisure activities, which in this way has completed an unrivalled corporate execution.

References

Adiloglu, B., PhD., & Vuran, B., PhD. (2012). The relationship between the financial ratios and transparency levels of financial information disclosures within the scope of corporate governance: Evidence from turkey. Journal of Applied Business Research, 28(4), 543-554

Aktas, R., Kayalidere, K., & Kargin, M. (2013). Corporate sustainability reporting and analysis of sustainability reports in turkey. International Journal of Economics and Finance, 5(3), 113-125

Allegrini, M., & Greco, G. (2013). Corporate boards, audit committees and voluntary disclosure: Evidence from italian listed companies. Journal of Management & Governance, 17(1), 187-216

Anuchitworawong, C. (2010). The value of principles-based governance practices and the attenuation of information asymmetry. Asia – Pacific Financial Markets, 17(2), 171-207

Ben, P. J. (2014). Corporate governance index and firm performance. Journal of Contemporary Research in Management, 9(3), 33-44

Burnett, R. D., Skousen, C. J., & Wright, C. J. (2011). Eco-effective management: An empirical link between firm value and corporate sustainability. Accounting and the Public Interest, 11, 1-15

Chan, M. C., Watson, J., & Woodliff, D. (2014). Corporate governance quality and CSR disclosures. Journal of Business Ethics, 125(1), 59-73

Cormier, D., & Magnan, M. (2014). The impact of social responsibility disclosure and governance on financial analysts’ information environment. Corporate Governance, 14(4), 467

Davis, S., & Lukomnik, J. (2013). Social issues come of age in corporate governance. Compliance Week, 10(110), 60-61

Del Baldo, M. (2012). Corporate social responsibility and corporate governance in italian SMEs: The experience of some “spirited businesses”. Journal of Management & Governance, 16(1), 1-36

Dragomir, V. D. (2013). Environmental Performance and Responsible Governance E+M Ekonomie a Management, (1), 33-51

Galbreath, J. (2011). Are there gender-related influences on corporate sustainability? A study of women on boards of directors. Journal of Management and Organization, 17(1), 17-38

Gulzar, M. A., & Wang, Z. (2010). Corporate governance and non-listed family owned businesses: An evidence from pakistan. International Journal of Innovation, Management and Technology, 1(2), 124

Haldar, P. K., & Mishra, L. (2015). The changing facets of corporate governance and corporate social responsibilities in India and their interrelationship. Information Management and Business Review, 7(3), 6-16

Harp, N., Myring, M., & Shortridge, R. T. (2014). Do variations in the strength of corporate governance still matter? A comparison of the pre- and post-regulation environment. Journal of Business Ethics, 122(3), 361-373

Kathyayini, K., Tilt, C. A., & Lester, L. H. (2012). Corporate governance and environmental reporting: An australian study. Corporate Governance, 12(2), 143-163

Kaya, C. T., & Aslan, L., CRMA. (2013). A research on the association between corporate governance and corporate performance in Turkish energy sector. GSTF Business Review (GBR), 3(1), 167-171

Lopatta, K., & Kaspereit, T. (2014). The world capital markets’ perception of sustainability and the impact of the financial crisis. Journal of Business Ethics, 122(3), 475-500

Luu, T. T. (2014). Corporate governance and brand performance. Management Research Review, 37(1), 45-68

Mallin, C., Michelon, G., & Raggi, D. (2013). Monitoring intensity and stakeholders’ orientation: How does governance affect social and environmental disclosure? Journal of Business Ethics, 114(1), 29-43

Md Habib-Uz-Zaman Khan. (2010). The effect of corporate governance elements on corporate social responsibility (CSR) reporting. International Journal of Law and Management, 52(2), 82-109

Michelon, G., & Parbonetti, A. (2012). The effect of corporate governance on sustainability disclosure. Journal of Management & Governance, 16(3), 477-509

Mishra, S., & Mohanty, P. (2014). Corporate governance as a value driver for firm performance: Evidence from india. Corporate Governance, 14(2), 265-280

Okongwu, U., Morimoto, R., & Lauras, M. (2013). The maturity of supply chain sustainability disclosure from a continuous improvement perspective. International Journal of Productivity and Performance Management, 62(8), 827-855

Peters, G. F., & Romi, A. M. (2014). Does the voluntary adoption of corporate governance mechanisms improve environmental risk disclosures? evidence from greenhouse gas emission accounting. Journal of Business Ethics, 125(4), 637-666

Porter, T., & Miles, P. (2013). CSR longevity: Evidence from long-term practices in large corporations. Corporate Reputation Review, 16(4), 313-340

Rahim, M. M., & Alam, S. (2014). Convergence of corporate social responsibility and corporate governance in weak economies: The case of Bangladesh. Journal of Business Ethics, 121(4), 607-620

Rodrigue, M. (2014). Contrasting realities: Corporate environmental disclosure and stakeholder-released information. Accounting, Auditing & Accountability Journal, 27(1), 119-149

Sanan, N. (2011). Corporate governance in public and private sector enterprises: Evidence from india. IUP Journal of Corporate Governance, 10(4), 37-59

Sun, N., Salama, A., Hussainey, K., & Habbash, M. (2010). Corporate environmental disclosure, corporate governance and earnings management. Managerial Auditing Journal, 25(7), 679-700

Valmohammadi, C. (2014). Impact of corporate social responsibility practices on organizational performance: An ISO 26000 perspective. Social Responsibility Journal, 10(3), 455

Wells, P., & Ingley, C. (2015). Interlocking directorships and the corporate-community connection: Evidence from the antipodes. Paper presented at the 523-531

Wolf, J. (2014). The relationship between sustainable supply chain management, stakeholder pressure and corporate sustainability performance. Journal of Business Ethics, 119(3), 317-32

We can write this or a similar paper for you! Simply fill the order form!