Industry & Company Analysis Project (Fall 2018)

Assigned Company: see list

Primary Competitor: from Industry/Sector

Use data from Yahoo!Finance, Google Finance, Mergent Online, Bloomberg, the company’s annual report, and other public data to complete the following.

Assignment: Conduct industry and financial company analysis of assigned company and its competitors to provide recommendation to management on future goals and strategy. Provide a written report which summarizes your analysis and provides recommendations to management. Your summary analysis should be based upon your detailed research of your assigned company, its industry/sector, and its competitors in the industry/sector.

SUMMARY ANALYSIS MUST INCLUDE (narrative with supporting charts and graphs; no more than

8 pages):

(1) Industry Overview and Analysis (25 pts). What is the industry outlook for your assigned

company? How does your company compare to competitors in the industry? Discuss the following:

a) Each company’s market share or market position.

b) How current economic conditions impact these companies.

c) Overall perception (leadership, goodwill, social responsibility, and employee relations) of

each company.

d) Future outlook of your company.

e) Market Ratios (also, compare to industry averages)

Price / Earnings Ratio

Price / Book Ratio

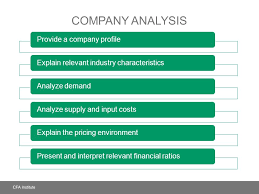

(2) Company Analysis Summary (20 pts). Discuss SWOT (strength, weaknesses, opportunities, and

threat) Analysis for your assigned company.

(3) Financial Ratio Analysis (40 pts). Compute and discuss the 3 year trend for your company and

one of its competitors using the most recent 3 years of annual financial statements. Compare and

contrast each company for the following ratios. Discuss the meaning of each ratio. Provide charts

and graphs to summary and highlight your findings.

a. Liquidity Ratios

Current Ratio

Quick Ratio or acid test

b. Solvency Ratios

Total Debt to Equity Ratio

Times Interest Earned Ratio (if company does not have interest expense, discuss the

meaning or impact)

c. Asset Management Ratios

Total Asset Turnover Ratio

Days Sales in Receivable Ratio

d. Profitability Ratios

Profit Margin Ratio

Return on Assets Ratio

1 | Page(4) Financial Trend Analysis (10 pts). Conduct a 3 year trend analysis of your assigned company’s

sales and profit growth trends. Discuss the outlook for your company.

(5) Stock Performance (25 pts). Compare and contrast the monthly stock price performance of your

company and one of its competitors over 36 months (3 years). Discuss each company’s standard

deviation, coefficient of variance, and beta as it relates to its standard alone and market risk. Provide

graphs to summary your findings.

(6) Investment and Capital Budgeting (20 pts). Discuss the company’s most recent and planned

capital budgeting activities. Discuss each company’s capital budgeting activities in comparison to the

industry. Discuss your inference from this data about the company’s growth potential.

(7) Recommendations (40 pts). Provide specific recommendations to the CEO to enable the company

to improve its financial position and growth, overcome potential weaknesses and threats, and

implement opportunities. Identify the time frame that these recommendations should be implemented

and what resources will be needed.

Format (10 pts). Submit one Microsoft Word file or Adobe (*.pdf) file containing the following:

An Industry Analysis report of less than 6 pages in the format of a Fact Sheet (see examples

posted on Blackboard)

Your name, assigned company and its competitor, and the industry/sector.

A written summary report with narrative, supporting graphs, tables, figures, and page numbers.

Figures and tables are embedded in the document (not a separate file) to supplement your

discussion. Do not expect the reader to interpret your figures and tables. Do not use charts and

graphs from Yahoo!Finance or other on-line sources.

All the topic areas listed above must be included. Use the bolded words for each item as a section

header before presenting the requested information.

Do not include extraneous information which does not support your analysis.

Include references, as appropriate. Note: this should be your analysis and not on-line analysis

from Yahoo!Finance and other sources.

Submit report via Blackboard before the due date listed in syllabus. Late submissions will receive a zero.

We can write this or a similar paper for you! Simply fill the order form!