Managerial Decision Making

Managerial Decision Making

Order Instructions:

Requested deadline NLT 5pm Saturday 1/23/16 must be at least 2 pages, which doesn’t include title & reference pages.

I am including the actual assignment from the course as well as the headings required, the chosen company is Wells Fargo. Please also use the following to access South University library as well as the syllabus. At least one source must be cited from the school library.

https://mycampus.southuniversity.edu/portal/server.pt? User Name – tiffany_shakepeare / Password – Pr@1seH1m Feel free to contact me at 334-201-0479

ASSIGNMENT DETAILS

Organization Project – 2: Managerial Decision Making

Research your chosen company. Find a minimum of one library source, which will support your thesis in this assignment. Review your assigned weekly lecture and text reading. Select from this reading 3-5 key concepts, which will also support your thesis. In a two to three page paper, address the questions below. Your paper should follow APA format including a title and reference page. The two to three page paper length requirement does NOT include the title page and reference page. Refer to your classroom area titled South University Policies and Guideline. Using APA Standards in Your Coursework to ensure you are following the correct format.

Describe some of the key decisions its management has faced within the past year or two. Identify an ethical issue the organization either faces or has faced in the past. If it has not been resolved, provide an analysis of how the issue should be addressed. If it has been resolved, critique how the organization resolved this issue based on the materials you have reviewed on ethical decision making.

The below are the headings to use for the above assignment:

Week Two Assignment

Introduction

You should write your introduction here. Describe what your paper is going to be about. Make sure you use third person referencing throughout your entire paper.

Key Managerial Decisions in the Past Two Years

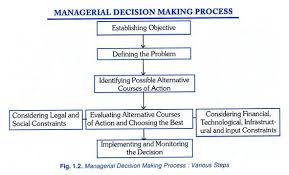

This section of your paper should describe some of the key decisions managers have made in the past two years. This is information you will need to interpret based on what you have read about the organization. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material. Hint the lecture materials on decision making as well as the text materials on Managerial Decision Making should be helpful.

Ethical Issue Organization has Faced

This section of your paper should describe some of the ethical issues the organization has faced. Again you will have to interpret this information based on what you have read about the organization.. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material. Hint the lecture materials on the Importance of Ethics and the text materials on Managing Ethics and Social responsibility should be very helpful in this section.

Conclusion

Write a one paragraph conclusion summarizing your paper.

References

SAMPLE ANSWER

Organization Project – 2: Managerial Decision Making

Introduction

Every business decision has a moral or ethical dimension since it has an effect on the company’s stakeholders (Robbins & Coulter, 2010). In this paper, some of the main decisions which the management of Wells Fargo bank has faced over the past 2 years are described in detail. An ethical issue which this company has faced within the past two years is also described. An analysis of how the ethical was resolved or should be resolved is provided basing on the materials reviewed on ethical decision making.

Key managerial decisions in the past 2 years

Over the past 2 years, the top management of Wells Fargo bank has made a number of key managerial decisions. Firstly, in order to improve sales and revenue for this financial institution and increase value for shareholders, Well Fargo’s senior executives in the year 2014 put tremendous sales pressure on the company’s staff members. The management also launched Wells Fargo’s going for gr-eight initiative which pushed the bank’s average client to have 8 dissimilar accounts. As a result of this initiative, Wells Fargo’s bankers were pressured to victimize clients or else face consequences such as getting fired for being unable to achieve sales quotas (Zacks investment research, 2015). Ethical decision making is the process in which the decision-maker assesses the ethical implications of a given course of action. In making the managerial decisions, Well Fargo’s top executives certainly did not assess the ethical implications of their decisions (Hartman, 2011).

Ethical issue that Wells Fargo has faced

In the year 2015, an ethical issue that Wells Fargo bank faced was treating its clients and staff members in an unethical manner. This financial firm was accused of setting unrealistic and unreasonable sales targets for its workers and encouraging its employees to adopt fraudulent means to meet the preset quota. Staffs at this corporation assumed deceitful tactics in achieving the stipulated impractical sales targets, for instance by issuing illicit credit cards, opening illegal and needless customer accounts, and forging signatures of clients and charging fees on accounts of clients who are unaware. When they got complaints from customers pertaining to this matter, Wells Fargo refunded such fees only in part and not in full, and it then misstated the phone numbers of those clients so that they are not reached for client satisfaction surveys. Furthermore, the senior managers of this bank did not protect the bank’s clients from the financial harm when they found out about the violations by their employees (Zacks investment research, 2015).

This issue has not yet been resolved by Wells Fargo. The case of Wells Fargo bank is a clear illustration of poor decision making in which the bank’s management made poor ethical decisions. For this issue to be resolved in an effective manner, it is recommended that Wells Fargo should reimburse its customers the fraudulent fees which it charged them and secondly, Wells Fargo should discontinue such unethical and deceitful practices in the future. Wells Fargo should focus on the best interest of its clients and create an ethical, caring and supportive environment for its employees and team members. Non-existent or weak governance structures at Wells Fargo resulted in poor ethical decision-making (Hartman, 2011). As such, Wells Fargo’s management should put in place effective business controls and oversight at all times. The managers should understand ways of leading ethically (Robbins & Coulter, 2010). Furthermore, people in this bank should learn ways of resisting to act in an unethical manner.

Conclusion

In conclusion, Wells Fargo’s senior management encountered an unethical issue when they pressured the employees to achieve impractical and unrealistic sales targets. As a result of this pressure, the bank’s employees utilized fraudulent tactics to attain the impossible targets. This ethical issue is yet to be resolved properly. A straightforward and practical solution is for this bank to pay back its customers the fraudulent fees which it charged them and cease its fraudulent practices in the future.

References

Hartman, L. P. (2011). Business ethics: decision making for personal integrity and social responsibility. New York, NY: McGraw-Hill/Irwin.

Robbins, S., & Coulter, M. (2010). Management (10th ed). New York, NY: Pearson Education Inc.

Zacks investment research. (2015). Wells Fargo sued by city of Oakland over predatory lending. Chatham: Newstex. Retrieved from http://search.proquest.com/docview/1715737472?accountid=87314

We can write this or a similar paper for you! Simply fill the order form!