Money laundry and terrorism financing strategies.

Investigating the consequences of the European Commission’s new list for third countries that have deficiencies on its money laundry and terrorism financing strategies. The case of Saudi Arabia and the efforts made to comply with FATE recommendations

Money laundry and terrorism financing strategies

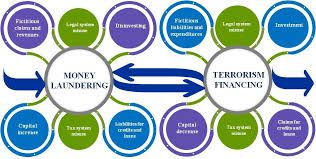

Money Laundry and Terrorism Financing are the most critical organized crimes that affecting the economic worldwide. They cost around 2% to 5% of the global GDP that is almost equal to $800 billion – $2 trillion (UNODC, 2019). However, there are huge efforts have been made by various regulatory bodies, professional organizations, and non-profit organizations such as the Financial Action Task Forces “FATF”, Banking supervision committee “BASEL” and the European union.

Money laundry and terrorism financing strategies

The European Union “EU” has introduced various regulations to fight ageist the Money laundry and Terrorism financing. The European commission, which is responsible for proposing legislations within the EU, adopts a new list for third countries that have deficiencies on its money laundry and terrorism financing strategies.

The kingdom of Saudi Arabia has been recently included on this list as high risk country that poses higher risk to the European financial system (European Commission, 2019).

Despite, there is no sanction involved; the reputational damage will heavily affect Saudi financial institutions. However, as per the regulations, European banks will be required to perform addition due diligence on Saudi banks’ Euros’ transactions and the kingdom will be subject for close monitoring until proper regulatory controls are being introduced.

One of the major issues that have been discussed in details by various parties including the European Union and FATF, as part of recommended controls to fight against money laundry and terrorism financing, is the identification of the ultimate beneficiary owner. The Saudi government has made huge efforts to enhance the national capabilities to combat financial crimes through updating existing legislations and enhancing the enforcement.

Various activities have been emphasized that must performed by financial institutions at the time of on-boarding clients to identify the true identity of the account’s beneficiary through additional due diligence according to the risk associated with client.

This research aims to investigate the consequences of the European Commission’s new list for third countries that have deficiencies on its money laundry and terrorism financing strategies considering the case of Saudi Arabia and the efforts made to comply with FATE recommendations to identify the ultimate beneficiary owner.

Research questions:

What is the European commission list for third countries and how does it affect listed counties?

What are the arrangements made by the concerned Saudi regulatory bodies to comply with Anti-Money laundry and counter Terrorism financing guidelines?

What are the measures introduced by Saudi banks to identify the ultimate beneficiary owner?

We can write this or a similar paper for you! Simply fill the order form!