Management situations at Wells Fargo Bank Order Instructions:

must be at least 4 pages, which doesn’t include title & reference pages, using APA formatting. Each paragraph should contain at least 4 sentences and should not end with citied material ex. (Franklin, 2015.)

I am including the actual assignment from the course as well as the headings required, the chosen company is Wells Fargo. Please use the following to access South University’s as all information must be supported by the weekly lecture & text reading (located under the syllabus tab) as well as the school library. Lecture readings from weeks 1-3. INTERNET SOURCES ARE NOT ACCEPTED.

https://mycampus.southuniversity.edu/portal/server.pt

Once you have logged in successfully you have to click launch class and then click the academic resource tab to access the library. When you click the syllabus it will give you access to the weekly lectures & text readings.

Please remember all references must come from these areas.

Assignment

Comprehensive

Research your chosen company. Find a minimum of three library sources, which will support your thesis in this assignment. Review your assigned weekly lecture and text reading. Select from this reading 8-10 key concepts, which will also support your thesis. In a four to five page paper, address the questions below. Your paper should follow APA format including a title and reference page. The four to five page paper length requirement does NOT include the title page and reference page. Refer to your classroom area titled South University Policies and Guideline: Using APA Standards in Your Coursework to ensure you are following the correct format.

In weeks one and two, you gathered information about an organization as it relates to planning and decision making. In this assignment, you will apply the functions of Planning, Organizing, and Controlling. You will be required to use concepts and analyze the current management situations at the organization you have chosen.

Your paper must include research and should include a clear introduction with a thesis statement and a conclusion. Your research paper should address the following:

Describe how the organization was managed in the past. Compare the difference between management approaches in the past to those the organization currently uses. Ensure you identify relevant management theory both for past practices and current approaches.

Describe how the organization is structured. Include a copy of the organizational chart. Describe how managers perform the organization function of management based on the structure of the organization. Ensure one of the five types of structures as described in the textbook is identified and analyzed.

Identify a key manager in the organization and describe his/her primary functions and responsibilities. Evaluate how effective this manager is in fulfilling these responsibilities in making clear recommendations for improvement. Ensure you refer to the functions of management as described in your textbook.

Describe how decisions are made in this organization. Using materials from the textbook or other relevant sources on decision makers evaluate the effectiveness of the decision-making process and make clear recommendations for improvement.

Describe the system of controls the organization uses. Include in this description how control is used to ensure the organization meets its goals and objectives as well as how the organization uses a quality control process to ensure products and/or services are delivered as promised. Evaluate the role of managers in these processes. Make clear recommendations for improvement. Ensure you refer to your textbook or other relevant sources in your evaluation.

Summarize the key recommendations you have made identifying each with the relevant function of management.

Include an APA formatted reference list and a title page (these do not count towards the minimum page requirements).

A note on this assignment. This is considered a midterm assignment. You will need to reflect not only on this week’s materials but also week one and two.

Week Three Assignment

Assignment Headings

Introduction

You should write your introduction here. Describe what your paper is going to be about. Make sure you use third person referencing throughout your entire paper.

Past Management Approach

In this section you should interpret how the organization was managed in the past. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material. Hint the lecture materials and reading materials from week one covered this material. Please use this.

Comparison of Management Approaches (Past and Present)

In this section you should be comparing management approaches from the past and the present and discussing how they have changed. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material. Hint the lecture materials and reading materials from week one covered this material.

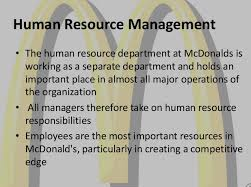

Managers Performance of Functions of Management Based on Structure of the Organization

This week we will be reading about and discussing different structures in organizations. Organizations are managed based on their structure. You should first identify how the organization is structured and then discuss how managers perform their roles. Remember in week one how we discussed the four functions of managers using this material as well as the lecture materials on organizational structure in your work. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material. Hint the lecture materials on organizational structure and the text materials on designing adaptive organizations should be very helpful.

A Key Manager: Primary Functions and Responsibilities

In this section you should clearly discuss a key manager and describe his or her responsibilities and the primary function the manager performs. Reflect back to both the lecture and textbook materials from week one. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material.

Effectiveness of Manager in Fulfilling this Role

In this section you should be interpreting how effective the manager is. Use the materials from week on to help you in this assessment. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material.

Recommendations for Improvement

In this section I am looking for clear recommendations for improvement. Refer back to what the text and lectures have stated about this. Please do not state you have no recommendations. All organizations need to improve. Attempt to identify these and use course materials to support why you think these are areas for improvement. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material.

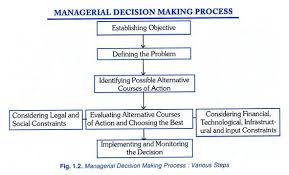

How Decisions Are Made

In this section you will revisit decision making that was discussed in week two. Describe how you think decisions are made in the organization. Please do not forget to use the materials in the lectures to support your work. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material.

Effectiveness of the Decision Making Process

This is where you will interpret the effectiveness of the decision making process. Go back to week two. Reflect on what you read about the elements of effective decision making. Include this material in your analysis. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material. Hint the lecture materials on

Recommendations for Improvement

In this section I am looking for clear recommendations for improvement. Refer back to what the text and lectures have stated about this. Please do not state you have no recommendations. All organizations need to improve. Attempt to identify these and use course materials to support why you think these are areas for improvement. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material.

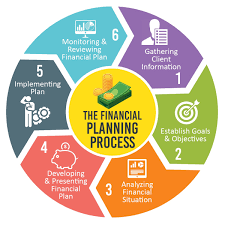

System of Controls the Organization Uses

This week a chapter of our text book focuses on controls: Managing Quality and Performance. This material should be used as you describe how the organization manages performance in terms of organizational success. What systems do they have in place? Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material.

Recommendations for Improvement

In this section I am looking for clear recommendations for improvement. Refer back to what the text and lectures have stated about this. Please do not state you have no recommendations. All organizations need to improve. Attempt to identify these and use course materials to support why you think these are areas for improvement. Minimally you should be writing one full paragraph with 4-5 sentences. You may need two paragraphs to fully address this. You should include one piece of information from the text or lectures to support your work. You must use in text citations to demonstrate you have used this material.

Summary of Key Recommendations

In this section you will simply summarize the key recommendations you have made in the three sections where you have made recommendations..

Management situations at Wells Fargo Bank Conclusion

Write a one paragraph conclusion summarizing your paper.

References

Management situations at Wells Fargo Bank Sample Answer

Management situations at Wells Fargo Bank

Introduction

In this paper, the functions of planning, organizing and controlling are applied. The current management situations at Wells Fargo Bank are examined comprehensively. How Wells Fargo was managed in the past and how it is currently structured is described. The primary responsibilities and functions of a key manager are described. Furthermore, the paper describes how decisions are made in this bank. The system of control used by Wells Fargo is also described and appropriate recommendations are made identifying each with the pertinent management function.

Past management approach: System approach

In the past, the management of Wells Fargo employed the system approach. Using this approach, the organization is viewed as an open and organic system that comprises interdependent and interacting components known as sub-systems. This past management approach is rooted in the generalization that all things are inter-reliant and interconnected (Kast & Rosenzweig, 2010). A system comprises reliant and related parts which, when in interaction, create a unitary whole (Daft, 2015). A system is basically a combination or assemblage of components or things creating a composite whole. The system comprises hierarchy of sub-systems.

Comparison of management approaches

At the moment, the management approach being utilized at Wells Fargo is the contingency approach also referred to as the situational approach. The top executives at this financial company realized that under different situations, management problems are different hence they have to be dealt with according to the demand of the situation. The contingency approach differs from the previously used system approach in that the contingency approach seeks to integrate theory with practice in systems framework (Kast & Rosenzweig, 2010). The organization’s behaviour is considered as being dependent on the environmental forces. Unlike the systems approach, the contingency approach supposes that the behaviour of any single subunit depends upon its environment as well as its association with other sub-units or units which have control over the sequences that are desired by that particular sub-unit.

Manager’s performance of functions of management based on organization structure

At Wells Fargo Bank, the organization structure adopted by the company is matrix structure. This organization structure is basically a combination of at least 2 kinds of organization structure, for instance the functional organization structure and the divisional structure. In the matrix organization structure, the functional manager’s authority flows vertically and the divisional manager’s authority flows sideways (Swarnalatha & Vasantham, 2014). The matrix organization structure at Wells Fargo creates power struggles given that many areas of the organization have a dual management – a divisional and a functional manager who work at the same level and more or less the same managerial territory.

A key manager: primary functions and responsibilities

At Wells Fargo Bank, one key manager is the company’s Customer Service Manager for Greater Los Angeles Area, Shelly Hisel. In his role, he is in charge of several customer service representatives who work face-to-face, live chat, over email, or call centres. He helps in building good customer relations. He arranges meetings of employees. He recruits staffs and carries out assessments, and handles queries and complaints from both employees and clients.

Effectiveness of manager in fulfilling this role

In fulfilling his roles at Wells Fargo Bank, Shelly Hisen has not carried out his functions very effectively. He has properly resolved problems between workmates and established ground rules and expectations. However, he has not been very effective in following guidelines of the firm for dealing with clients and resolving problems from clients as they crop up. He has not handled queries and complaints from clients in an adequate and proper manner. A case in point, when Wells Fargo bank faced an unethical issue by treating its clients in an unethical manner for instance by forging signatures of clients and charging fees on accounts of clients who are unaware, Shelly Hisen disregarded many customer complaints and did not resolve customer complaints satisfactorily or properly.

Recommendations for improvement

To improve on his roles as a customer service manager, Shelly Hisel should lead and motivate his team of Wells Fargo employees to make sure that they actually give the most excellent customer service possible. He should also communicate the company’s policies and products to other staff members at this firm (Daft, 2015). As the company’s customer service manager, Shelly Hisen should ensure that his team actually does its best in meeting the needs of clients by providing useful tips on a product and troubleshooting problems. He can also make recommendations on ways of resolving customer issues.

How decisions are made

At Wells Fargo Bank, decisions are made using the political model. Managers at this firm usually engage in coalition building for making decisions that are complex. It is worth mentioning that a coalition is essentially an informal alliance amongst managers who support a particular common objective (Daft, 2015). Various managers form alliances in coalition building process. If there is no coalition, a powerful group or person in the company can disrupt the process of decision-making.

Effectiveness of the decision making process

The decision making process using the political model at Wells Fargo is for the most part effective. Coalition building provides many managers in this company a chance of contributing to the process of decision making, which serves to enhance their commitment to the alternative which is adopted in the end. This political model has particularly been effective at Wells Fargo for making non-programmed decisions when there is little information and conditions are uncertain (Daft, 2015). It is also very useful when there are conflicts amongst managers regarding which goals the company needs to pursue or which course of action should be taken.

Recommendations for improvement

In order to improve the process of decision-making at Wells Fargo bank, it is recommended that the key managers at this company should at times adopt the classical model or the administrative model of decision making. For instance, the classical model of decision is most practical whenever it is applied to programmed decisions. It also useful in decisions which are typified by risk or certainty given that pertinent information is available and it is possible to calculate probabilities (Daft, 2015). Effective managers at Wells Fargo can also utilize a mix of intuition and rational analysis to make difficult decisions under the pressure of time. Intuition, which is a vital part of administrative decision making, plays a more and more crucial role in decision-making.

System of control the organization uses

Organizational control is basically understood as the systematic process that is used to regulate activities in an organization in order to make them at one with the expectations established in targets, plans as well as standards of performance (Silva Gonçalves, 2010). At Wells Fargo, the system of control used is the Balanced Scorecard. This approach takes a balanced perspective on the performance of the organization and integrates different aspects of control which focus on clients and markets, in addition to financials and staff members. This system of control is comprehensive.

Recommendations for improvement

In order to improve organizational control at Wells Fargo, it is recommended that the company’s management combine the Balanced Scorecard approach with other approaches to organizational control such as the Feedback Control Model and the Total Quality Management (TQM) philosophy. Using the 4 steps of feedback control, managers at Wells Fargo should establish control systems which comprise 4 main steps: creating standards, measuring performance, comparing performance to standards, and making necessary corrections (Daft, 2015). By using TQM techniques, Wells Fargo would make a company-wide effort aimed at infusing quality into all activities within the firm by way of continuous improvement (Silva Gonçalves, 2010). These two approaches should not replace the current Balanced Scorecard approach, but should rather be used together with the balanced scorecard. This would help to improve organizational control at Wells Fargo.

Summary of key recommendations

A summary of the key recommendations made in the three sections above are as follows. First, for Wells Fargo’s customer service manager Shelly Hisen to improve on his roles, he has to lead and motivate his team to make sure that they really give the finest customer service possible. Secondly, to improve the process of decision-making at this financial institution, it is recommended that the key managers at this firm should sometimes adopt the classical model or the administrative model of decision making whenever necessary. To improve organizational control, it is recommended that the senior management at Wells Fargo combine the Balanced Scorecard approach with other approaches to organizational control including the Feedback Control Model and Total Quality Management techniques.

Management situations at Wells Fargo Bank Conclusion

In conclusion, the present management situations at Wells Fargo Bank have been described in this paper exhaustively. In the past, Wells Fargo was managed using the classical management approach and its current organizational structure is a matrix. One of the key managers, the Customer Service Manager, helps in building good customer relations and he arranges meetings of employees. He also handles queries and complaints from both employees and clients. Decisions are made in this bank using the political model. Furthermore, the system of control used by Wells Fargo is the Balanced Scorecard.

Management situations at Wells Fargo Bank References

Daft, R. L. (2015). Management (10th ed). Columbus, OH: South-Western College.

Kast, F. E., & Rosenzweig, J. E. (2010). Organization and management: A systems and contingency approach (3d ed.). New York: McGraw-Hill

Pimentel, L., & Major, M. J. (2014). Quality management and a balanced scorecard as supporting frameworks for a new management model and organizational change. Total Quality Management & Business Excellence, 25(7-8), 763-775. doi:10.1080/14783363.2014.904568

Silva Gonçalves, H. (2010). Proposal for a strategy model planning aligned with the balanced scorecard and the quality environments. The TQM Journal, 21(5), 462-472. doi:10.1108/17542730910983380

Swarnalatha, C., & Vasantham, S. T. (2014). Organization structure-an overview. Indian Streams Research Journal, 4(6), 1-3.